Digital ID and Programmable Money: The Other Face of “Financial Modernization” in Mexico and worldwide

When people talk about central bank digital currencies (CBDCs), the same promise is repeated over and over: faster payments, lower costs, more financial inclusion. But in speeches by figures like Agustín Carstens and the BIS, there’s a crucial piece that rarely gets discussed openly: digital identity.

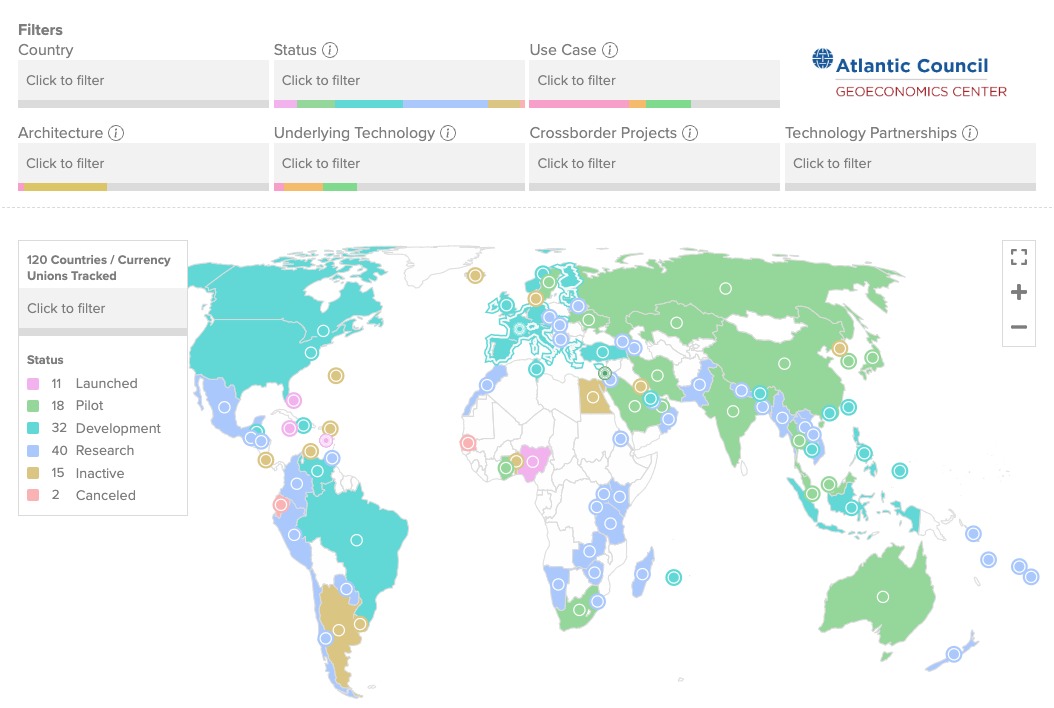

In the following map, it show that Mexico is in a polote stage as European Union and EEUU as countries deploying the digital currency CBDCs.

https://www.cbdc.cc/

It is particularly troubling that Mexican actors are playing a leading role in this process. Such is the case of Agustín Carstens, former governor of the Bank of Mexico, who currently serves as General Manager of the Bank for International Settlements (BIS), one of the institutions operating behind the agenda of financial system digitalization on a global scale.

In practice, he has become a central figure in the architecture and promotion of CBDCs within the BIS framework, influencing the way central banks conceive and design these schemes of central bank digital money, despite the implications this has for financial surveillance and the erosion of privacy.

People here even use him as an example to ridicule:

https://www.youtube.com/watch?v=CzPXn1sU7Zk

In most of the designs currently under discussion, the CBDC does not come “by itself”; it comes embedded in an ecosystem with:

-

An account or wallet in your name.

-

Verified identity (KYC: Know Your Customer).

-

Rules of use (limits, traceability, etc.).

The digital ID comes in precisely at point 2:

to give you a CBDC wallet, the system has to know who you are.

It sounds convenient. But that’s where the problem is: comfort in exchange for total control.

There are already people who have been stopped at airports not because of what they did, but because of what they “appear” to be in a database. Someone on a blacklist follows someone on social media, the algorithm connects the dots, and suddenly a random traveler is denied entry even though they have no idea who that follower is. What used to be a human suspicion is now an automated inference. And when a machine makes a mistake, there’s no one you can really argue with.

In Mexico, all of this is being built almost in silence. The so-called DIGITAL ID here is sold under the name **Llave MX**. It was imposed in 2022 and almost no one noticed. Now it’s coming “full force,” integrated into more and more procedures.

What’s the problem? That it **centralizes** everything:

* Your INE (voter ID)

* Your birth certificate

* Your mobile phone account

* Your medical consultations

* The Ministry of Education (SEP) asks for it for school procedures

* The tax authority (SAT) is starting to integrate it

* IMSS uses it for medical appointments

* Universities request it

* Your degree and professional license already require it

In other words: your identity, your health, your education, your income, your assets, and your daily life all begin to converge in a single point of control. A single “profile” that will keep being fed year after year.

WHAT’S THE BIG DEAL? That this is not just a tech upgrade; it’s a shift in power.

This model is being pushed in several countries through pressure and coercion, driven by central banks and international organizations (BIS, IMF, World Bank, G20, etc.). At the same time, the famous **central bank digital currencies (CBDCs)** are being designed. Digital ID + digital money + everything linked to the same record: do we really think that has no political and social consequences?

Countries like Mexico buckle under pressure with the argument that “we can’t fall behind” and that “this is modernity.” And along the way, we quietly accept that any current or future government, and any “authorized” company, can profile and condition the lives of its citizens.

Carstens doesn’t hide it. He has said that the debate on identification in CBDCs has to be seen in the broader context of digital ID. In plain terms: talking about CBDCs is not just talking about a new form of money; it’s talking about a new model of mandatory identity in order to use that money.

From Anonymous Cash to a Wallet With Your Name on It

With cash, money doesn’t “know” who is using it. A bill can move from hand to hand without leaving a trail. With a CBDC, that changes completely.

In most of the designs currently under discussion, a CBDC doesn’t come by itself. It comes embedded in an ecosystem that includes:

- An account or wallet in your name

- A verified identity (KYC: Know Your Customer)

- A set of rules of use (limits, traceability, filters, alerts, etc.)

Digital identity sits right at the heart of the system:

to give you a CBDC wallet, the system has to know who you are. That’s not optional; it’s the entry ticket.

Digital ID as “Public Infrastructure”: Nice Words, a Lot of Power

The BIS presents digital identity as a kind of essential public infrastructure. In their documents, they say these systems can help govern data, improve competition and guarantee “good governance.”

It sounds reasonable… until you look at what it means in practice.

If a single digital credential —your ID— is the key to:

- real-time payment systems,

- CBDCs,

- financial services,

- and potentially other records (health, taxes, employment),

then you are building a master key. A key that links almost everything you do: what you earn, what you spend, what you owe, what you buy, and from whom.

The promise is “efficiency.” The risk is something else:

a massive concentration of information and power in the hands of a few actors (states, central banks, big tech companies).

The “Finternet”: You Only Enter if Your Papers Are in Order

In the proposal for the so-called “Finternet” or unified ledger, co-authored by Carstens and Nandan Nilekani (architect of India’s Aadhaar system), they describe a world where, to participate in new tokenized financial platforms, you need strong credentials: a passport, a national digital ID card, or similar.

In other words, the new “financial internet” is not as open as the internet we’re used to. You don’t get in with just an email address. You get in with an official, verified, state-sanctioned identity.

Who gets left out?

- Migrants without regular papers

- People in the informal economy

- Anyone who distrusts putting all their data into a centralized system

The paradox is clear:

we are told this is about financial inclusion, but the model can end up creating an economy where those who refuse or cannot comply with the digital ID regime are, in practice, pushed to the margins.

When Data Starts Running Your Everyday Life

The segregation and exploitation of data is even more alarming if we look at how data is collected and who controls it. In many cases, this information ends up in the hands of private technologies and, in countries like Mexico, foreign companies that buy, sell and share databases, often without people really knowing or understanding what’s going on.

Example 1:

Your monthly car insurance payment suddenly goes up, with no clear explanation. Why? Because your car, full of digital tech, sent your driving data to the insurer. An algorithm ran a risk assessment and decided you’re a high-risk driver just because you slammed on the brakes hard outside your house when your cat ran in front of the car as you arrived from work. The machine doesn’t know that detail. It only sees “harsh braking,” logs it and sends it on.

Example 2:

Your thermostat might not be “smart,” but your utility company has already installed a smart regulator on your home. Suddenly, on the coldest days, your heating never seems to go high enough. It’s not a glitch: the system is throttling your usage to “manage demand.” Some nights you end up sleeping in a hotel because your house is simply too cold.

These are not sci-fi scenarios; they’re real stories from people already living this in different countries. They show what happens when sensors, algorithms and opaque contracts start making basic decisions about your life, while you’re not really at the table where those rules are designed.

Now imagine that same logic applied not just to your car or your heating, but to your money.

The Dangerous Combo: CBDC + Digital ID + New Infrastructures

Taken separately, a digital currency or an identity system might seem controversial but manageable.

The real problem is the combo:

- CBDC – money that is 100% traceable and, in many designs, programmable

- Digital ID – a single credential that identifies you everywhere

- Unified infrastructures – platforms where everything is connected and coordinated, often built with private and foreign technology

Together, they open the door to things that sound extreme today, but are technically quite possible:

- Tracking every single movement of your money in microscopic detail

- Setting personalized limits: how much you can spend, in which categories, in what locations and at what times

- Applying automatic financial penalties: partially blocking your wallet, preventing certain purchases, or freezing funds based on your “risk profile” or behavior, defined through data you may not even know exists, much less correct

All of this can be justified “under the law,” wrapped in friendly language: safety, anti-money laundering, system protection, stability.

Modernization or a New Form of Control?

The BIS insists that combining CBDCs, digital ID and new infrastructures will modernize the financial system and improve inclusion. Some technical benefits might be real: faster payments, lower transaction costs, simpler processes.

But the potential price is huge:

we could move from an imperfect but fragmented system (where at least your data is scattered) to a hyper-concentrated system where a single architecture controls:

- who you are,

- what you own,

- how you use it,

- and under what conditions.

The question is no longer just whether we want a “digital peso” or not.

The deeper question is: who holds the key?

If that key is a mandatory digital identity, tied to programmable money and to a unified, commercializable data network, we’re not just digitizing finance. We’re redesigning from the ground up the relationship between citizens, the state, tech corporations and money. That’s not a technical detail. It’s a political shift of the highest order.

It is particularly troubling that Mexican actors are playing a leading role in this process. Such is the case of Agustín Carstens, former governor of the Bank of Mexico, who currently serves as General Manager of the Bank for International Settlements (BIS), one of the institutions operating behind the agenda of financial system digitalization on a global scale.

In practice, he has become a central figure in the architecture and promotion of CBDCs within the BIS framework, influencing the way central banks conceive and design these schemes of central bank digital money, despite the implications this has for financial surveillance and the erosion of privacy.

People here even use him as an example to ridicule:

https://www.youtube.com/watch?v=CzPXn1sU7Zk

And again, in most of the designs currently under discussion, the CBDC does not come “by itself”; it comes embedded in an ecosystem with:

- An account or wallet in your name

- Verified identity (KYC: Know Your Customer)

- Rules of use (limits, traceability, etc.)

The digital ID comes in precisely at point 2:

to give you a CBDC wallet, the system has to know who you are.

Related content: https://youtu.be/NwL5vmF0NLg?si=0dNHxYNJ6D4lLJ5I