When Did Mexico’s Digital Currency Really Begin?

The Decision Almost No One Noticed

The Decision Almost No One Noticed

In Mexico, the central bank digital currency —the so-called CBDS or MDBC or “digital peso”— is surrounded by confusion.

Some say it doesn’t exist, others say it’s in testing, others think it was approved secretly. But the key question is much simpler:

When did they officially say: “yes, let’s start this”?

The answer isn’t hidden. It simply was never clearly explained to the public. Below is a breakdown of the basic pieces, with official documents and press reports that show when Mexico formally activated its digital currency project.

1. The real starting point: December 2021

The true origin of the project is found in a technical document published quietly and without public attention: the Payment Strategy of the Bank of Mexico, released in December 2021.

In that document, Banxico included for the first time an entire section titled:

“IV.4. Platform for Central Bank Digital Currencies (MDBC)”

This is not a theoretical essay. It is part of the official payment policy of the country. In other words:

This is the moment Banxico institutionalized the development of a digital currency.

Before that document, Mexico had no formal policy on a central bank digital currency.

After December 2021, it did. That was the “yes, we are going to work on this.”

You can read the document here:

Payment Strategy of the Bank of Mexico (PDF, December 2021)

2. The public announcement that confirmed everything

A few weeks later, on December 30, 2021, the official account of the

Government of Mexico on X/Twitter published a message that grabbed media attention:

“@Banxico reports that by 2024 it will have its own digital currency in circulation, considering these new technologies and next-generation payment infrastructure as highly valuable options for advancing financial inclusion in the country.”

That tweet was interpreted as the public confirmation of a decision already made internally by Banxico. It was the political complement to the technical decision.

You can see the message here:

Government of Mexico announcement on the digital currency (December 30, 2021)

3. Media reaction: from a technical document to the “digital peso”

After that announcement, national and international media began covering the story, linking the payment strategy with the government’s tweet. Among them:

“Mexico prepares a new digital currency for 2024” – El País

“Banxico will launch its digital currency for 2024” – Forbes Mexico

The narrative quickly solidified: Mexico had formally activated its digital currency project at the end of 2021, with a tentative horizon of 2024 for potential circulation.

4. What happened next: “initial phase” and quiet development

Although the political announcement was direct, the Bank of Mexico adopted a more cautious tone afterward. In presentations throughout 2022 and 2023, Banxico described the project as being in an “initial phase”, focused on:

- Defining the technological architecture and operational models.

- Analyzing legal, technical, and financial-stability implications.

- Evaluating risks and potential impacts on the payment system.

One example is the presentation titled “Challenges and Perspectives of the Central Bank Digital Currency”(September 2022), where Banxico again cites the 2021 Payment Strategy as the origin of the project:

“Challenges and Perspectives of the Central Bank Digital Currency” – Banxico (PDF)

This confirms that the digital currency is not an isolated idea, but a structured project integrated into the central bank’s official strategy.

5. Why does identifying the start date matter?

Knowing the exact moment Mexico said “yes, let’s start” is key to understanding both the political and technical processes behind the digital currency. It marks the dividing line between:

- “We are studying the topic” (purely exploratory).

- “We have integrated the digital currency into our official payment strategy and are developing it”.

That leap happened at the end of 2021, when:

- Banxico published the Payment Strategy and included the

“Platform for Central Bank Digital Currencies (MDBC)” as an official policy pillar. - The Government of Mexico publicly announced that the central bank would have a digital currency “by 2024.”

After that, everything else —initial phases, prototypes, follow-up presentations— is simply the development of a decision already made.

6. In summary

When someone asks: “When did they truly say: yes, let’s start this?” the answer, backed by documents, is:

At the end of 2021.

It wasn’t a rumor, a leak, or speculation. It came from a formal institutional document of the Bank of Mexico, followed by a public announcement from the federal government that together marked the official launch of Mexico’s digital currency project.

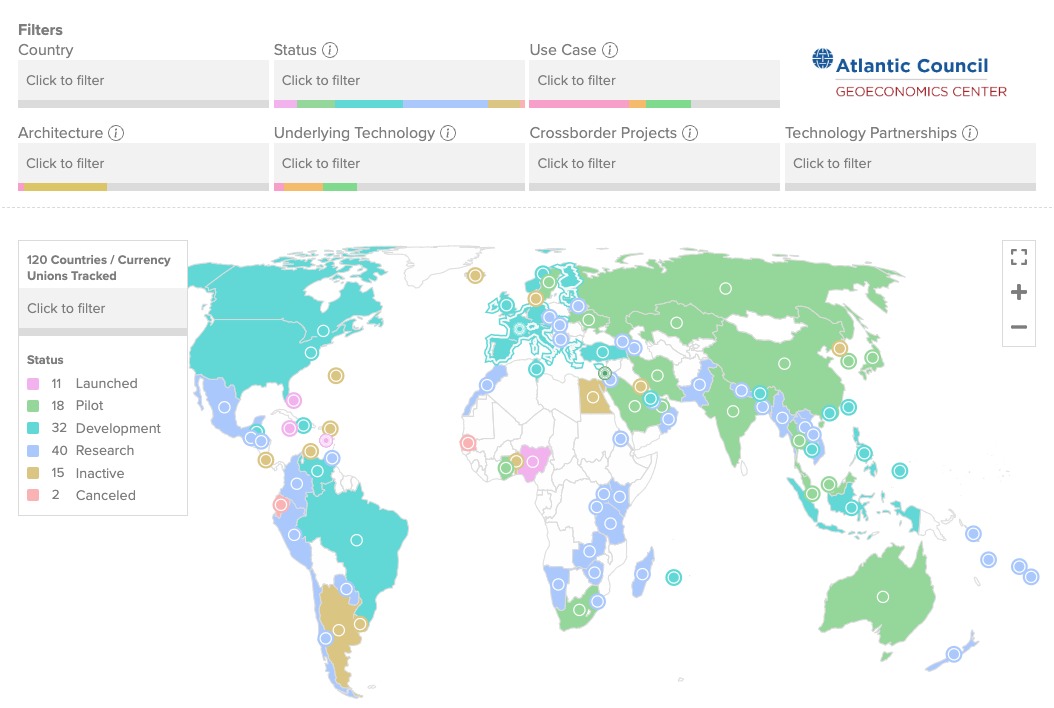

You can track the Mexican CBDCs in the following source: https://www.cbdc.cc/