Why Sellers Compare Etsy’s registration policies to Authoritarianism

For years, Etsy marketed itself as a vibrant marketplace for creativity — a space where small sellers and independent artisans could reach global buyers without the barriers of big retail. But in recent years, many sellers have begun to notice a shift. What once felt like a community-driven platform now feels more like an authoritarian system where rules are handed down, compliance is mandatory, and questioning those rules gets you nowhere. A lot of independent sellers feel that way.

Etsy started back in 2005 as a kind of craftspeople’s marketplace with a very community-driven ethos. But since going public in 2015, it has had to satisfy shareholders—most notably institutional investors like BlackRock and Vanguard—which often leads to policies that feel heavy-handed or “authoritarian” for sellers.

This story connects directly to what happens with platforms like Etsy: once investors step in, the community-driven ethos erodes, replaced by policies or changes that make financial sense on paper but alienate the very people who built the brand’s reputation.

What sellers say today about Etsy?

Some examples sellers often point to:

-

Fee increases (transaction, listing, and advertising fees have gone up several times).

-

Mandatory programs (like offsite ads, where Etsy automatically advertises your listings and takes an extra fee if a sale comes through that ad).

-

Policy enforcement that can feel rigid, with sudden shop suspensions or demands that don’t allow for much dialogue.

-

Pressure to scale—many small makers feel Etsy prioritizes volume sellers or manufactured goods, which runs against the original handmade spirit.

It can feel like the platform is less about empowering artisans and more about maximizing revenue for investors.

It can feel overwhelming when it looks like giant financial institutions are steering everything, even places that were meant to support independent creators like Etsy. Once a company goes public, it stops being just about its mission and starts revolving around quarterly earnings, often putting shareholders like BlackRock and Vanguard at the center of decision-making.

These firms, which hold stakes in countless companies because they manage massive retirement funds and ETFs, don’t necessarily want to run marketplaces directly, but their influence makes policies feel less human and more like numbers on a spreadsheet.

Surveillance Creep

To open a shop today, providing your bank account and email is no longer enough. Etsy now demands government-issued IDs, biometric selfies, and third-party verification through private corporations. For many sellers, this doesn’t feel like simple security — it feels like surveillance. The kind of identity checks once associated with border crossings or government security agencies are now required just to sell a pair of earrings or a handmade candle online.

No Transparency

Perhaps most frustrating is the lack of explanation. Some sellers are charged a $15 setup fee, others $29, and still others report around $35. Why the difference? Etsy doesn’t say. Sellers are told their accounts may be “flagged” for additional verification — but what triggers that flag is never made clear. Like authoritarian systems, the rules feel arbitrary, and enforcement depends on invisible decisions you cannot appeal.

Reviews about horror stories of not protecting sellers

https://www.consumeraffairs.com/online/etsy.html?page=3

Unequal Treatment

In practice, this means two sellers with the exact same credentials can face different hurdles. One may open a shop with no fee, while another — equally legitimate — is asked to pay simply because Etsy’s automated systems marked them as higher risk. This lack of consistency creates a chilling effect. Sellers don’t feel empowered; they feel watched, judged, and sometimes punished without cause.

Corporate Authoritarianism

What makes this worse is that Etsy isn’t a government agency. It’s a private corporation, financed by investors, driven by profit. Unlike a state, it has no democratic oversight, no public accountability. Yet, it now demands information and control that rivals what governments collect. For sellers, this looks less like a creative marketplace and more like a corporate surveillance state, where identity itself is commodified and traded as part of the platform’s business model.

The Bigger Picture

Etsy is not alone. Across the digital economy, more platforms are outsourcing identity checks to private firms, turning data into a commodity and burdening users with opaque rules. What begins as a security measure quickly turns into control. And when compliance is tied to your ability to earn a living, the power imbalance becomes stark.

Closing Thought

Sellers compare Etsy to authoritarianism not because the platform is a government, but because it behaves like one — demanding intrusive information, offering no transparency, and leaving no room for appeal. What was once a celebration of independence and creativity now risks becoming another example of how corporations exercise unchecked authority in the digital age.

Alternatives to Etsy

Still, the human side of creativity survives outside this system: smaller platforms such as GoImagine, ArtFire, and Big Cartel continue to emphasize artisans and ethical values; direct-to-customer paths like Shopify or WooCommerce give sellers independence and brand control, even if growth is slower; and local markets or fairs remain powerful spaces where the connection between craft and community thrives without algorithms or corporate fees.

Here’s a friendly and clear comparison of Etsy and top alternatives, highlighting which ones offer more control, lower fees, community support, or alignment with handmade values.

| Platform | Control & Branding | Fees | Audience / Learning Curve | Best For… |

|---|---|---|---|---|

| Etsy | Low (marketplace brand) | Listing + transaction + ads | Huge existing audience | Easy start with broad reach |

| Amazon Handmade | Low | High | Massive, but strict entrance | Wide exposure if you’re okay with fees |

| Shopify | Very High | Monthly (no listings) | High: self-marketing needed | Full control and scalability |

| Big Cartel | High | Free to low | Low to moderate | Tiny shops seeking simplicity |

| Zibbet | Moderate | Monthly | Moderate | Multi-channel with unified management |

| ArtFire | Moderate | Tiered monthly | Moderate; community-focused | Sellers looking for community and visibility |

| GoImagine | Moderate | (Not specified) | Small, but mission-driven | Handmade purists seeking ethical platform |

What is ETF and how this related to Etsy?

ETF stands for Exchange-Traded Fund. Think of it as a basket of investments (like stocks, bonds, or commodities) that you can buy or sell on the stock market just like a regular stock.

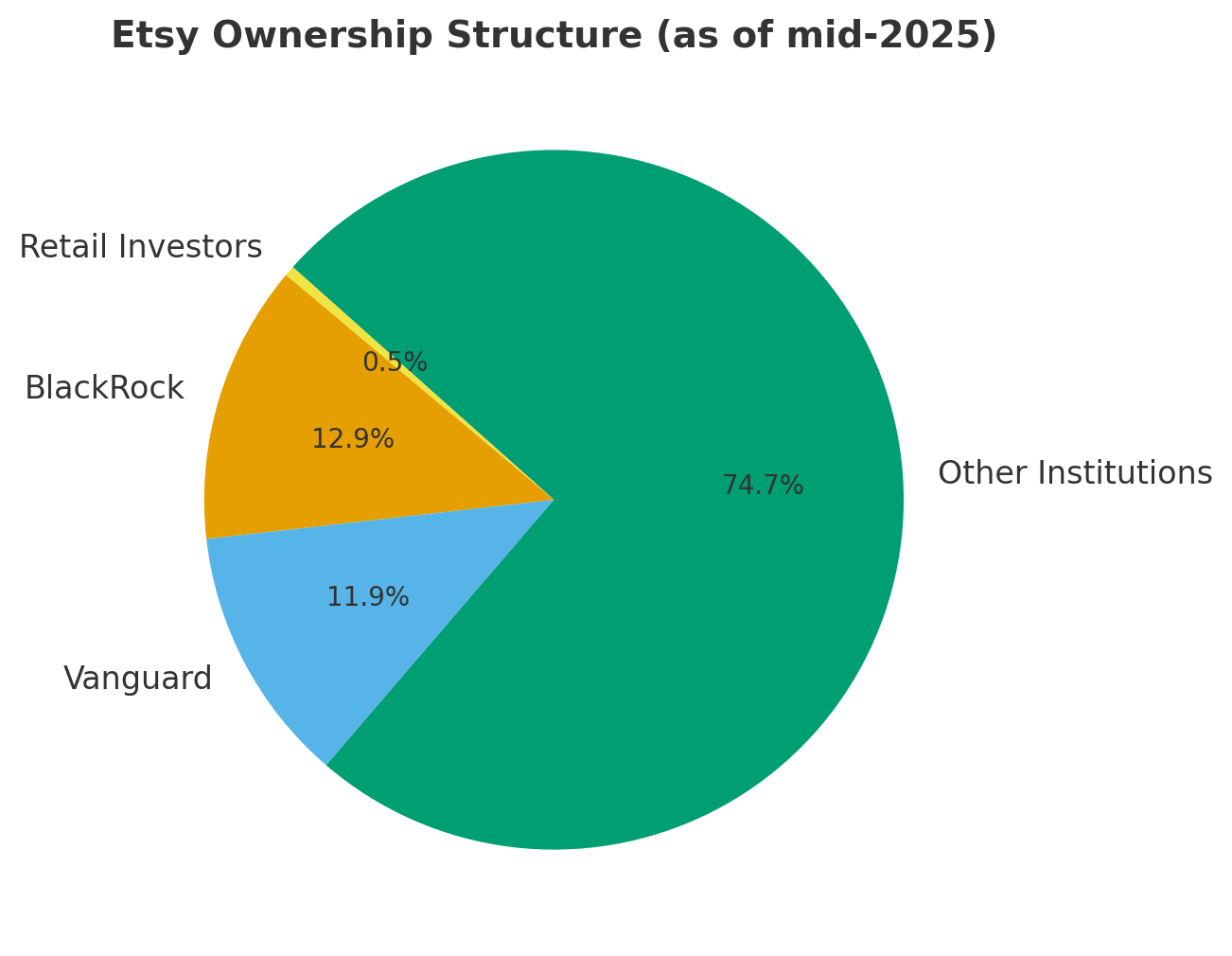

This visualization shows just how dominant institutional ownership is at Etsy—almost all of the company is in the hands of large investment firms, with very little owned directly by individual investors.

Here’s the updated chart using the real mid-2025 data:

-

BlackRock: 12.9%

-

Vanguard: 11.9%

-

Other Institutional Investors: 74.7%

-

Retail Investors: 0.5%

in the pie chart, each color slice represents one category of Etsy’s shareholders.

-

BlackRock → one slice (they own shares mostly through their ETFs, like iShares funds).

-

Vanguard → another slice (also mainly via their ETFs).

-

Other institutional investors → pension funds, mutual funds, hedge funds, etc.

-

Retail investors → regular people buying Etsy stock directly.

So yes: the slices labeled BlackRock and Vanguard essentially represent ETF-driven ownership, since most of their holdings come from ETFs and index funds.

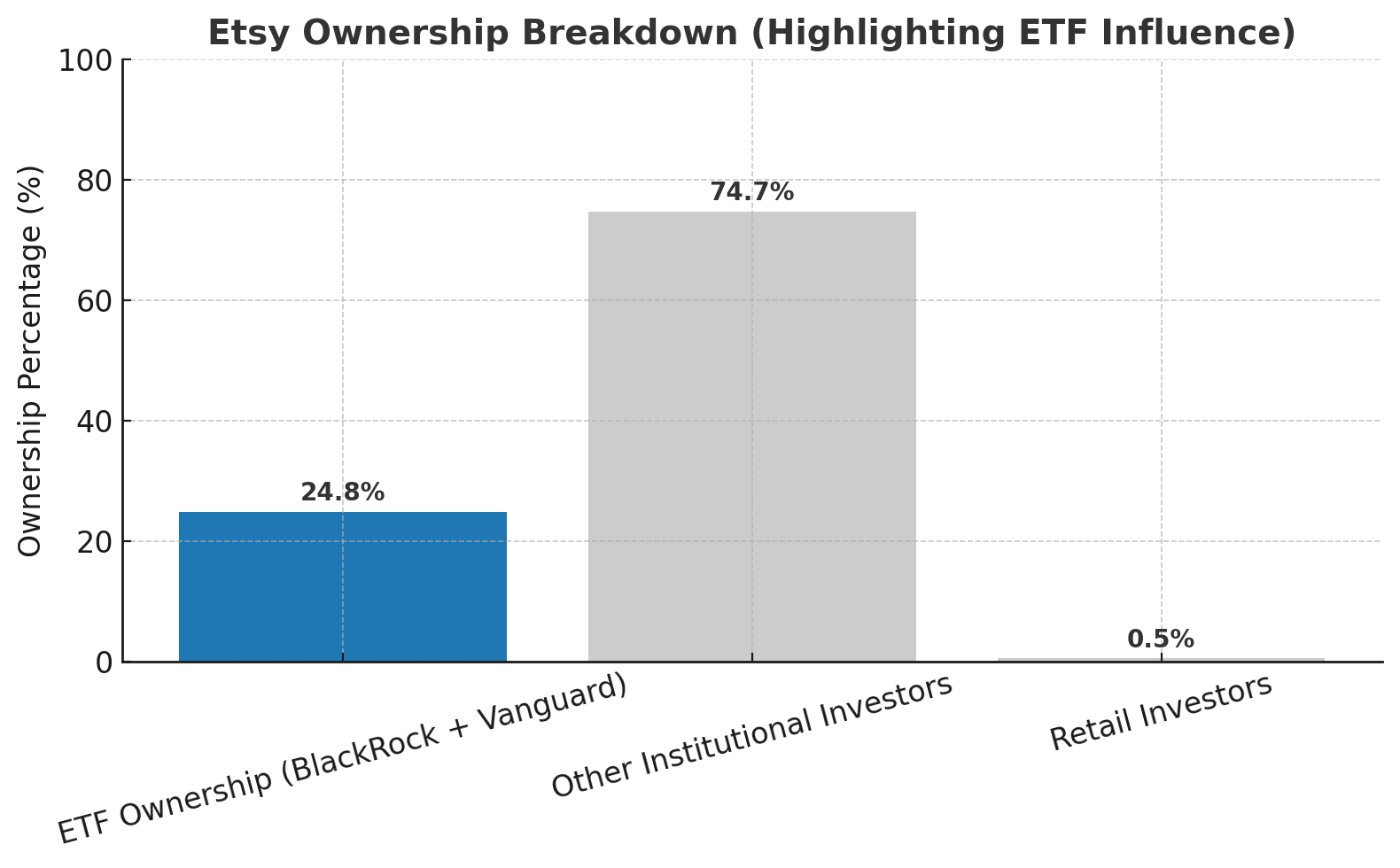

This shows how nearly a quarter of Etsy is held through ETF giants, while the rest is almost entirely other institutions, with individual investors barely present. This matters because the concentration of ownership in large passive funds like BlackRock and Vanguard gives them enormous influence over corporate governance and strategy, even though their business model is simply to mirror the stock market. In practice, this means Etsy’s leadership often prioritizes policies that appeal to institutional investors—such as steady revenue growth, predictable earnings, and scalable operations—rather than policies that preserve the community-driven, artisan-friendly ethos the platform was founded on. For sellers, the effect is a marketplace that feels increasingly corporate and rules-driven: higher fees, mandatory ad programs, stricter enforcement, and a shift toward mass-produced goods that generate more profit, even if it undermines the original handmade spirit.

Here’s a bar chart that highlights ETF-driven ownership in Etsy:

-

ETF Ownership (BlackRock + Vanguard): 24.8%

-

Other Institutional Investors: 74.7%

-

Retail Investors: 0.5%

Here’s how it works:

-

A single ETF might hold hundreds of different company shares. For example, the S&P 500 ETF includes stock from 500 of the largest U.S. companies.

-

When people invest in ETFs (often through retirement accounts or mutual funds), the money is pooled together, and firms like BlackRock (iShares brand) or Vanguard manage those funds.

-

Because millions of people use ETFs to save for retirement, these firms end up owning large chunks of stock in many companies at once—not necessarily because they want to control those companies, but because they’re managing the pooled investments of regular people.

The result: even though you and I might just own a small retirement account, firms like BlackRock and Vanguard hold the actual shares on our behalf—giving them huge voting power and influence in corporate decisions.

Credit. Orchestrated Writing ((human as conductor, ChatGPT as instruments))

Augmented Authorship