CHARACTERISTICS OF AN ECONOMIC RECESSION

Recession periods bring with them economic difficulties that, logically, translate into negative political and social impacts. This often means that all sectors of the economy decrease: both the production of goods and services, their consumption (especially those that are not essential), capital investment and also the generation of employment, since many companies tend to go to bankruptcy.

Recession Plus Inflation

On the other hand, when the economic recession is accompanied by a rise in general prices (inflation), we’re now talking of stagflation: economic stagnation together with inflation. It is one of the worst possible scenarios for the economy of any country to enter recession while already in inflation-up curve.

*Inflation is cause by printing too much money.

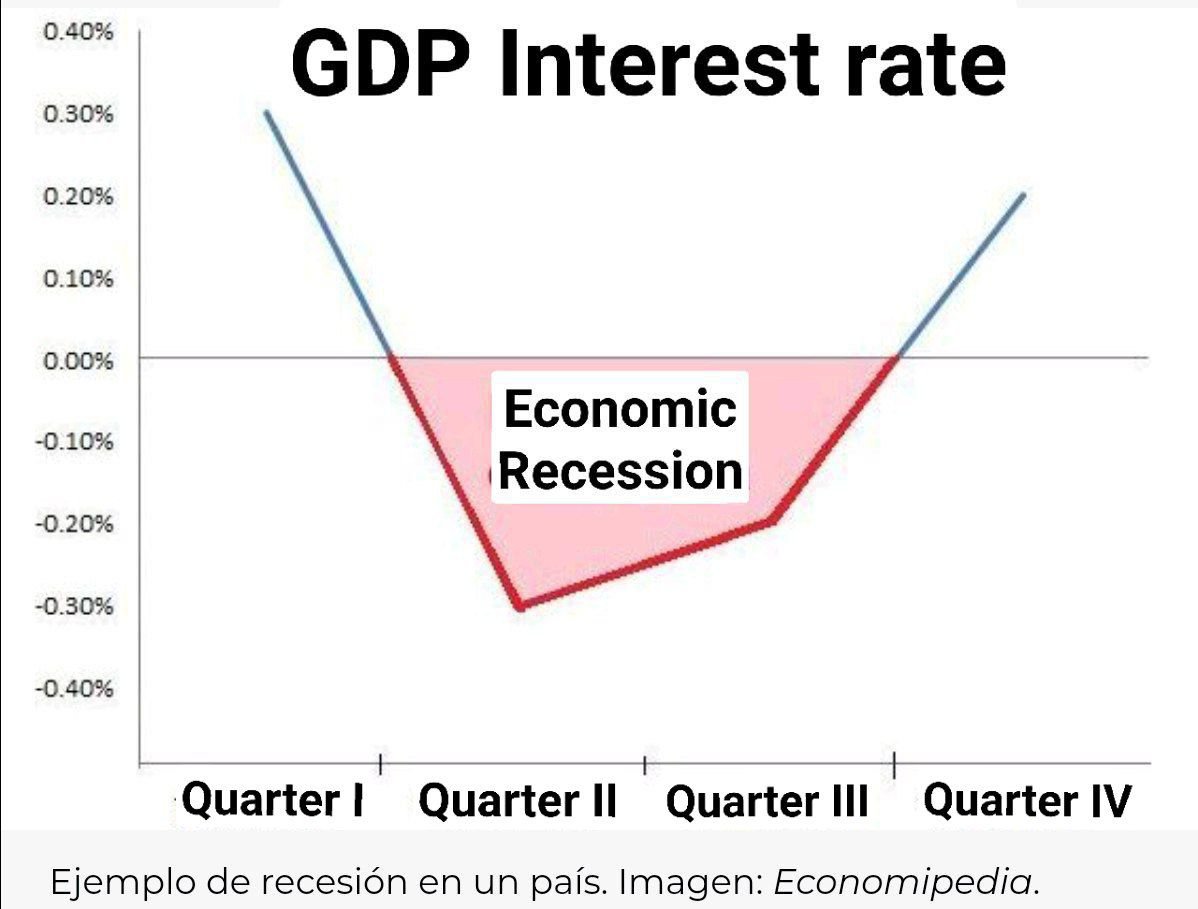

One of the many measures (indicators) used to see if a country is going into recession is GDP. The drop in GDP is caused by central bank regulatory actions when they focus on fighting inflation (by raising interest rates).

Similarly, when a recession does not come on slowly, but rather is sharp and sudden, it is often referred to as an economic crisis and often requires extraordinary measures to save the economy from going under.

In scenarios of political, social or economic uncertainty, investors prefer to play conservatively, since nobody wants to take more risks than they should. This often means that bad political decisions or social conflicts are accompanied by an economic tailwind that tends to recession.

Massive loss of capital can cause a recession. This can occur at a regional or even global level, due to major conflicts or problems, such as wars , revolutions, natural tragedies, or massive economic bailouts to banks and large companies.

The next step of the Recession is the Depression

When an economic recession is very intense for an extended period, the use of the term economic depression is preferred. So the latter is a more pronounced degree of recession, in which the economy tends not to slow down, but to become paralyzed or, worse, to total collapse .

The last recorded depression in the United States was in 1929, when people were left without work, without power, without housing, and without food. Large protests and food lines ensued, where churches were providing meals, and middle and upper-class families ended up living in the streets in the winter. These are some of the images that are remembered in the historic American Great Depression of 1929 that lasted a long decade.

Moral economists believe that under a recession threat, the best approach is not to focus on only stimulating the economy at the top (trickle-down economics), but instead the economic stimulus should be injected from the bottom up (trickle-up economics). Therefore, allocating bailouts in the hands of consumers which in turn will generate demand for products and services. That should be accompanied by consumer’s stimulus programs, development and infrastructure progrns (Marshal plan), and strategic interest rates set by the Federal Reserve or central banks in each country.

.

Mexico used trickle-up economics during the pandemic, and currentky their economy has grown 0.1%, acording to its economic secretary Tatiana Clouthler. And gas prices are lower than the U.S. between $1.50 to 3.00 dollars per gallon.

“If the interest rate does not rise, large companies survive inflation, but citizens do not. In contrast, if interest rates are lowered, investment and growth are generated for the majority of the people, mid-and small businesses, but some large companies and banks have some losses and little growth for a period of time —which does not affect the majority, only a small segment of the population. ” President of Mexico Lopez Obrador wrote in his book Hacia una economía moralToward a Moral Economyexplaining the modern concept or “Tickle-up Economics.”

This article is available in Spanish

CARACTERÍSTICAS DE UNA RECESIÓN ECONÓMICA